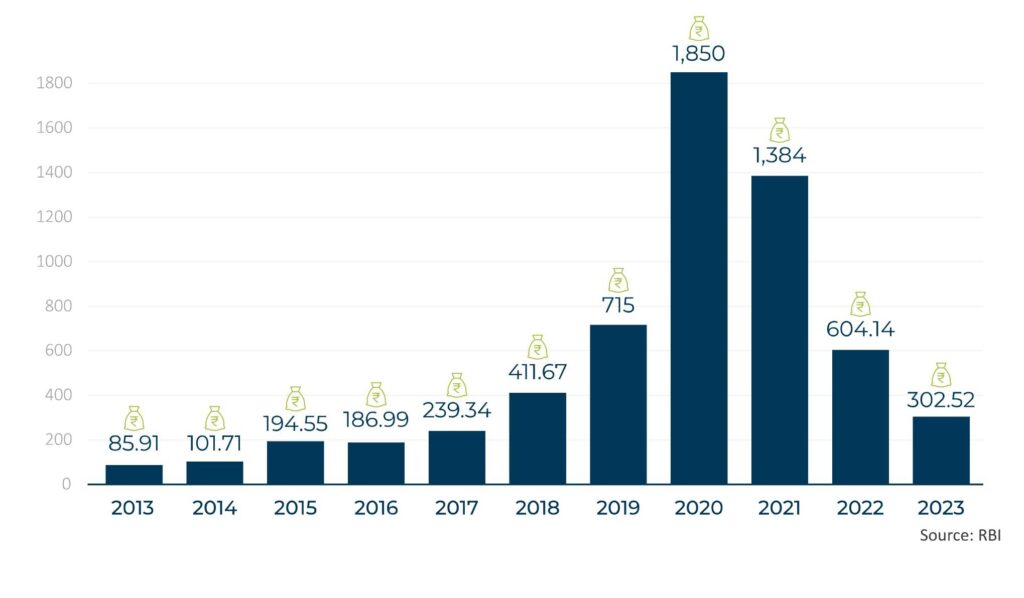

In recent years, India has witnessed a surge in fraudulent activities within the banking sector, with digital payment platforms emerging as a primary target for illicit transactions. According to the Reserve Bank of India’s (RBI) Annual Report for the fiscal year 2022-23, 13,530 instances of bank fraud, amounting to INR 30,252 crore were reported. Alarmingly, nearly half of these cases- 6,659, were attributed to digital payments facilitated through cards or the internet. This underscores the growing vulnerability of digital platforms to fraudulent activities, posing a significant challenge for both financial institutions and consumers alike.

While the figures for FY2023 show a slight decrease compared to the previous year, when reported bank frauds surpassed INR 1.3 trillion, the magnitude of financial losses remains concerning. Despite efforts to curb fraudulent activities, the persistence of such incidents emphasises the critical need for heightened vigilance among all stakeholders involved in the financial ecosystem.

Types of Bank Frauds

| Fraud Type | Description | Modus Operandi |

| Phishing Scams | Tricking individuals into revealing personal information. | Through deceptive emails or websites mimicking legitimate institutions. |

| Account Takeover | Gaining unauthorised access to a bank account. | Uses stolen login details obtained via phishing, malware, or social engineering. |

| UPI Fraud | Unauthorised transactions via Unified Payments Interface. | Deceiving victims into revealing UPI PINs or approving fraudulent payment requests. |

| QR Code Scams | Scams initiated by scanning a QR code. | Presenting malicious QR codes that trigger unauthorised transactions or malware downloads. |

| Mule Accounts | Account used to receive and transfer illegal funds on behalf of others. | Recruiting individuals to transfer illicit funds, making tracking difficult. |

| Digital Banking and Credit Card Frauds | Unauthorised access to digital banking or credit cards. | Stealing details through phishing, skimming, or breaches for fraudulent transactions. |

| ATM Fraud | Illicit cash withdrawals or data theft. | Using skimming devices on ATMs or capturing PINs through observation or hardware. |

| Identity Theft | Using someone else’s identity for fraud. | Obtaining personal details to impersonate the victim for financial gain. |

| Online Banking Fraud | Unauthorised online banking transactions. | Phishing and malware to steal login credentials and financial information. |

| Investment Scams | Deceptive promises of high returns on investments. | Misleading victims about investment opportunities, often with no real underlying value. |

Bank Frauds in India (Estimated Value – FY2013 to FY2023)

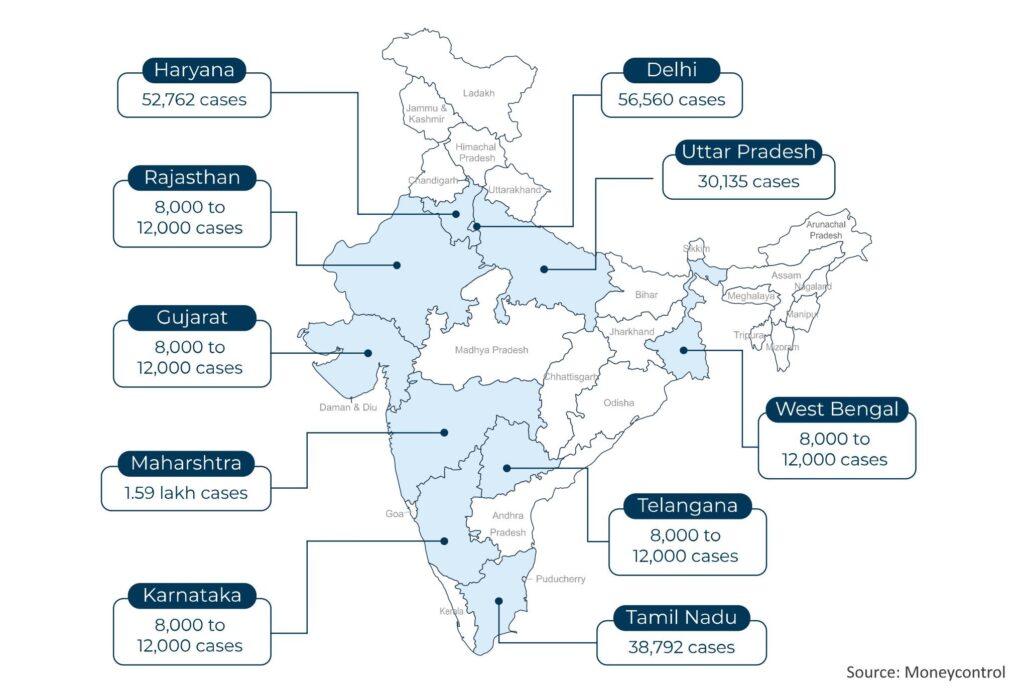

Hotspots of Bank Fraud Cases (FY 2013-14 to FY 2022-23)

What to do in case of fraud?

Contact Your Bank:

- Call 14440 or your bank support service to notify the fraud.

- Report the incident and provide details of the fraudulent activity.

- Request them to freeze or block any compromised accounts or cards.

Contact local Cyber Cell or local Police Station:

- Report the cyber fraud to the local police or Cyber Cell.

- File a First Information Report (FIR) and obtain a copy for legal purposes.

Lodge a Complaint with National Cyber Crime Reporting Portal (NCRP):

- Visit the NCRP website- https://www.cybercrime.gov.in/.

- File a detailed complaint about the cyber fraud, including financial losses and relevant communication.

Provide Documentation:

- Gather evidence such as transaction records, emails, and messages related to the fraud.

Contact Other Relevant Authorities:

- Reach out to regulatory bodies or CERT-In for specific sector-related frauds or significant cybersecurity incidents.

Preventive Measures

For Banks

- Ensure that the bank’s security policies are up-to-date and in line with emerging threats. Communicate these policies to users regularly to keep them informed about security measures in place.

- Conduct regular awareness campaigns to educate users about common fraud schemes, such as phishing, identity theft, and social engineering.

- Advise users to create strong, unique passwords for their accounts and to change them regularly.

- Offer users the option to subscribe to fraud alert services, which notify them of any unusual activity on their accounts via email, SMS, or app notifications.

- Encourage users to use secure banking channels, such as the bank’s official website or mobile app, for conducting transactions. Warn against using public Wi-Fi networks or unsecured devices for banking activities.

For Businesses and Individuals

- Regularly monitor bank statements and transactions for any unauthorized activity.

- Enable transaction alerts and notifications on mobile banking apps for immediate alerts.

- Use secure payment gateways and avoid sharing sensitive banking information over email or phone.

- Implement multi-factor authentication for online banking and payment transactions.

- Educate employees on recognizing and reporting potential phishing scams and fraudulent activities.

- Invest in cybersecurity measures, including robust antivirus software and regular software updates.

- Conduct periodic security audits and risk assessments to identify vulnerabilities.

- Consider cyber insurance policies to mitigate financial losses due to fraudulent activities.

- Stay informed about the latest fraud trends and security best practices through industry updates and training sessions.

- Report any suspicious activity or unauthorized transactions to the bank and relevant authorities promptly.